Grand Cayman, Cayman Islands, October 12, 2016 – CCRIF SPC (formerly the Caribbean Catastrophe Risk Insurance Facility) is now preparing to make additional payouts totalling almost US$8 million to CCRIF member countries. These payouts will be made to Haiti, Barbados, Saint Lucia and St. Vincent & the Grenadines as a result of the heavy rains from Hurricane Matthew, which triggered payments on these countries’ Excess Rainfall policies.

Last week CCRIF announced that the Government of Haiti is due a payout of approximately US$20.4 million on its Tropical Cyclone (TC) policy as a result of Hurricane Matthew. The payouts to Haiti from CCRIF will now total US$23.4 million. Similarly, Matthew triggered Barbados’ TC policy, resulting in a payout of a little under US$1 million under that policy for a total payment to Barbados of US$1.7 million as a result of Matthew.

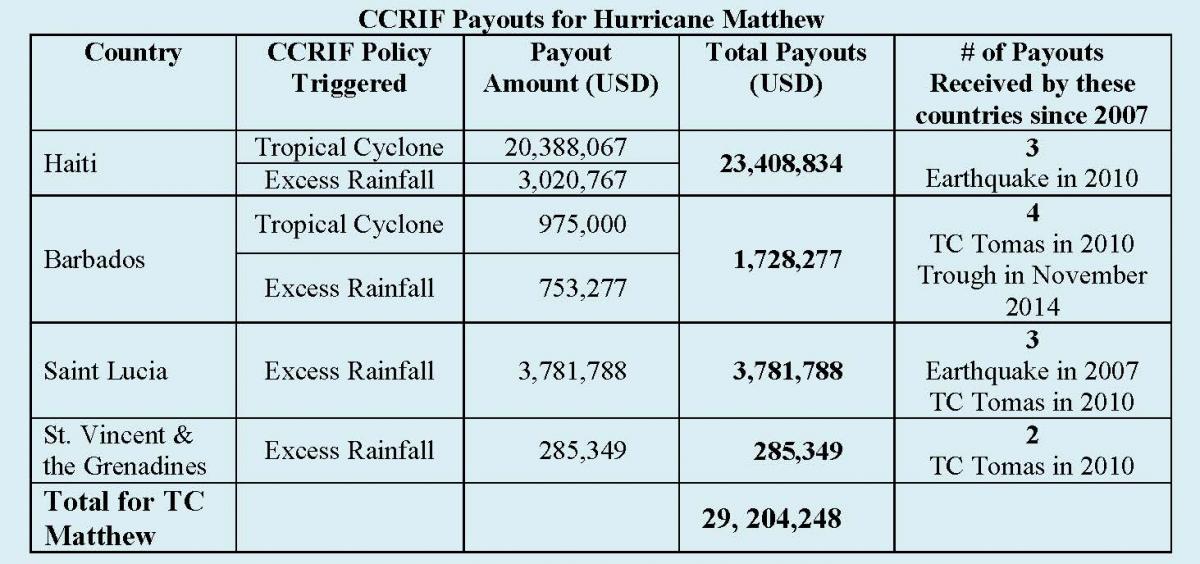

The payouts for all countries due to Hurricane Matthew, which will be made by October 19th, are presented in the table below.

Since CCRIF’s inception in 2007, the facility will have made a total of 21 payouts to 10 member governments totalling almost US$68 million, all within 14 days of the event.

As the Government and people of Haiti – and the international community – attempt to address the devastating impacts of Hurricane Matthew and the severe hardships being encountered by the people of Haiti, CCRIF is gratified that it can provide some immediate financial relief for urgent needs. We congratulate the Government on its foresight to obtain catastrophe insurance and express thanks to the Caribbean Development Bank for paying the country’s premiums over the last four years. Again, we offer our condolences for the loss of life and regret the extreme damage to Haiti’s communities.

After the announcement of the first payout, Minister of Finance, Yves Bastien, informed CCRIF that “the Government of Haiti - on behalf of the people of Haiti - appreciates the promptness with which CCRIF responded by triggering a payment of a little more than US$20 million. This payout is of upmost importance in our effort to bring some relief in different parts of the nation. Your organization may be certain we will be on your side for very long.”

In a CARICOM press release dated October 10, 2016, CARICOM Secretary General, Ambassador Irwin LaRocque, is quoted as saying: “The early response to the aftermath of Matthew as well as the supportive facility put in place to help resource the required recovery and rebuilding effort also underline the critical importance of the regional institutional frameworks established by the Community, CDEMA and the Caribbean Catastrophe Risk Insurance Facility (CCRIF), which has already processed payment to two of the affected countries, Barbados and Haiti.”

CCRIF is able to make quick payouts because it offers parametric insurance products. CCRIF’s TC policies make payments based on hurricane wind speed and storm surge levels and the amount of loss calculated in a pre-agreed model caused by the hurricane. They do not include losses due to rainfall. To fill this gap, CCRIF’s Excess Rainfall (XSR) product was developed in 2013. Excess Rainfall policies make payments based on the volume of rainfall from a hurricane or other rain event. A country’s TC or XSR policy is automatically triggered when the modelled losses surpass the policy’s “attachment point” or deductible, which was selected by the government.

Most CCRIF members have purchased both Tropical Cyclone and Excess Rainfall policies to provide coverage against these perils which sometimes occur during one hazard event such as Hurricane Matthew. Many members also have earthquake coverage. Member countries proactively incorporate CCRIF catastrophe insurance – as an example of effective risk transfer – into their national disaster risk management strategies as they seek to make their communities and economies more resilient to natural hazards and climate change.

About CCRIF SPC: CCRIF SPC is a segregated portfolio company, owned, operated and registered in the Caribbean. It limits the financial impact of catastrophic hurricanes, earthquakes and excess rainfall events to Caribbean and – since 2015 – Central American governments by quickly providing short-term liquidity when a parametric insurance policy is triggered. It is the world’s first regional fund utilising parametric insurance, giving member governments the unique opportunity to purchase earthquake, hurricane and excess rainfall catastrophe coverage with lowest-possible pricing. CCRIF was developed under the technical leadership of the World Bank and with a grant from the Government of Japan. It was capitalized through contributions to a Multi-Donor Trust Fund (MDTF) Government of Canada, the European Union, World Bank, the governments of the UK and France, the Caribbean Development Bank and the governments of Ireland and Bermuda, as well as through membership fees paid by participating governments. The Central America SP is capitalized by contributions to a special MDTF by the World Bank, European Commission and the governments of Canada and the United States.