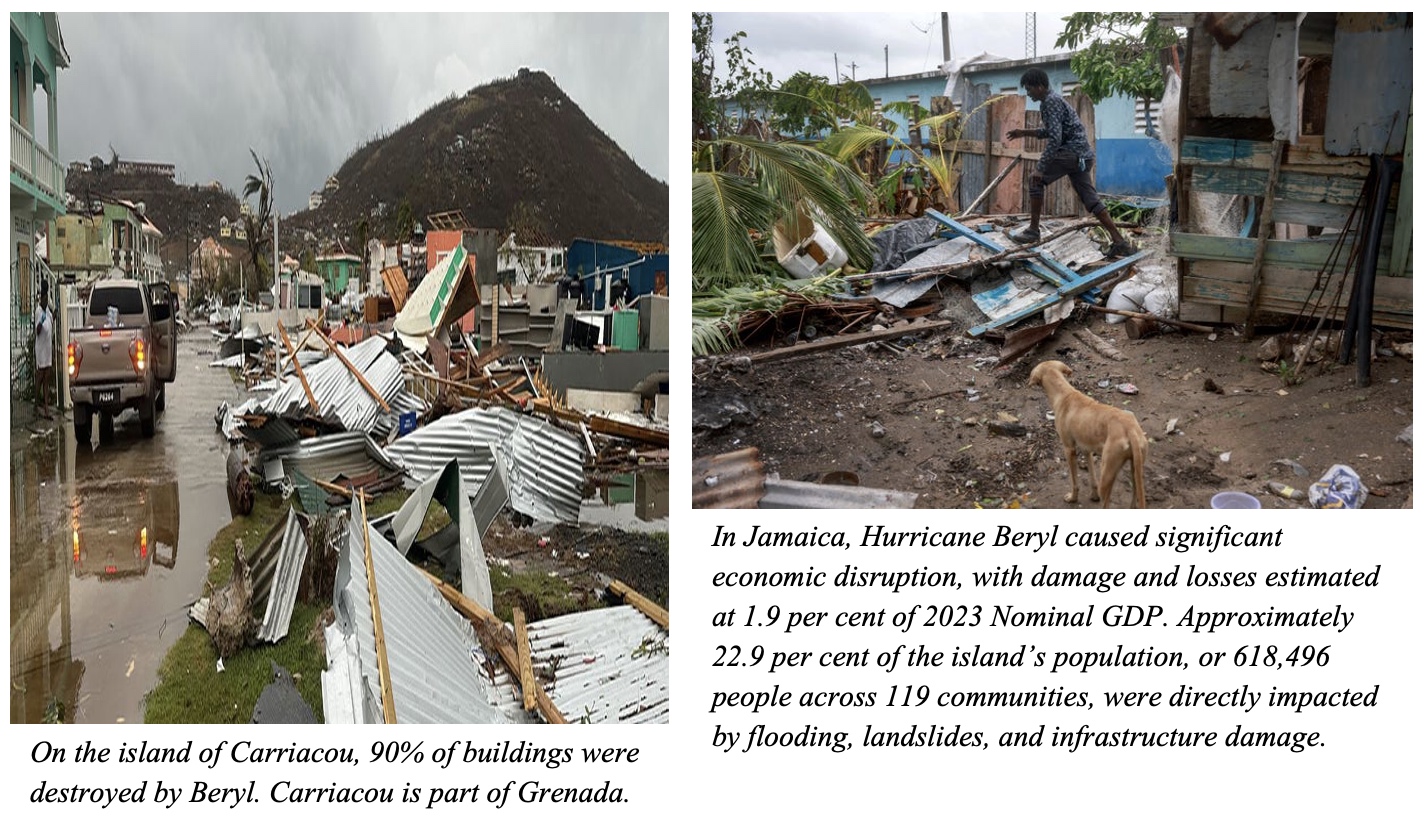

Hurricane Beryl impacted several Caribbean islands in July 2024 - Grenada, St. Vincent and the Grenadines, Jamaica, Trinidad and Tobago, Barbados, Saint Lucia, Dominica, and the Cayman Islands. CCRIF made payouts totalling US$84.5 million to 7 CCRIF members within 14 days of the hurricane to: the Governments of Grenada, St. Vincent and the Grenadines, Trinidad and Tobago, and Jamaica; GRENLEC (Grenada’s electric utility); NAWASA (Grenada’s water utility); and the Cayman Turtle Conservation and Education Centre (CTCEC). NAWASA and CTCEC are among CCRIF’s newest members that joined in June 2024. Hurricane Beryl also reminded us that disaster risk management needs to be mainstreamed across all sectors, and all stakeholders at the national, local, regional and global levels have a role to play in helping to shape the resilience agenda.

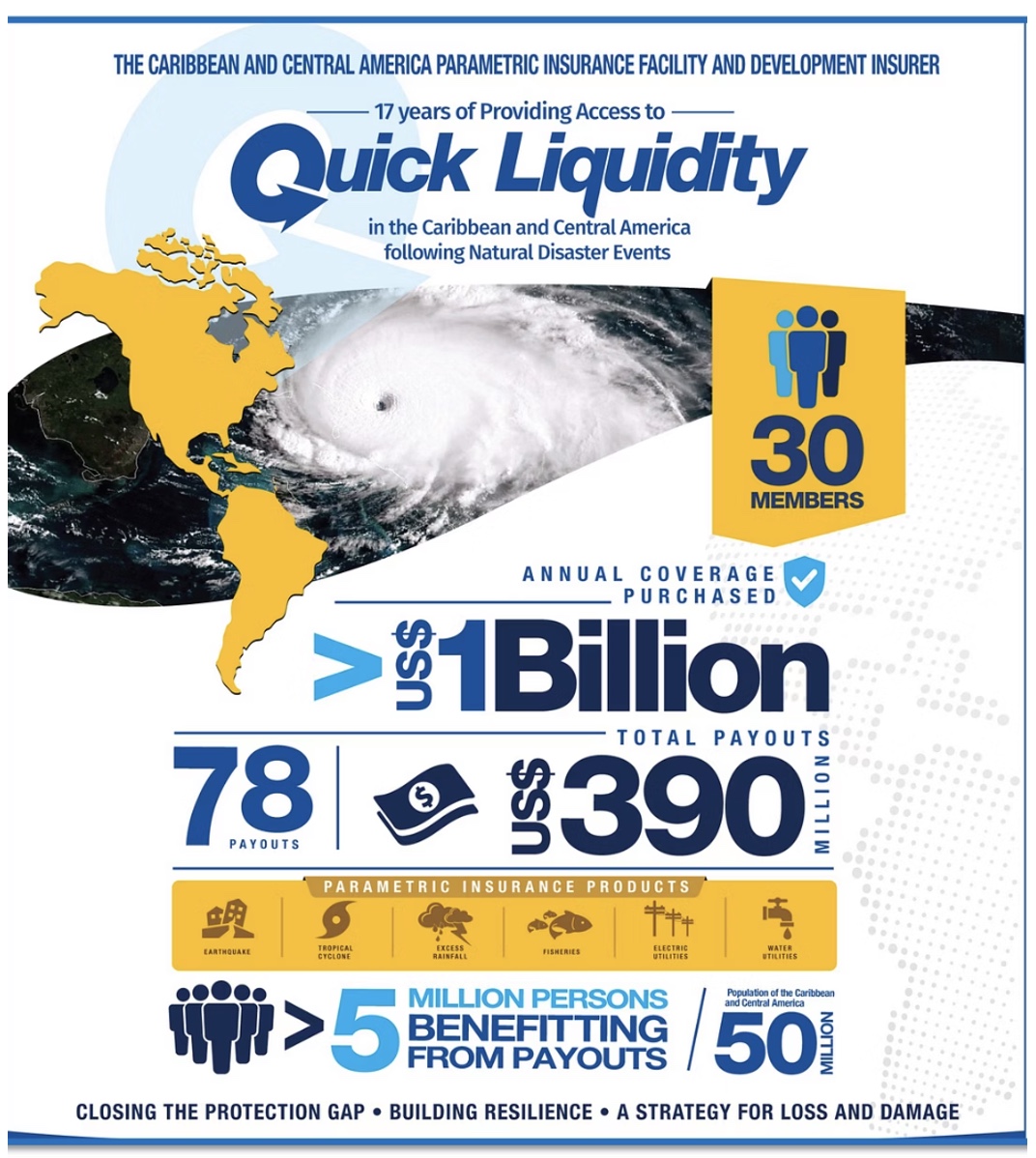

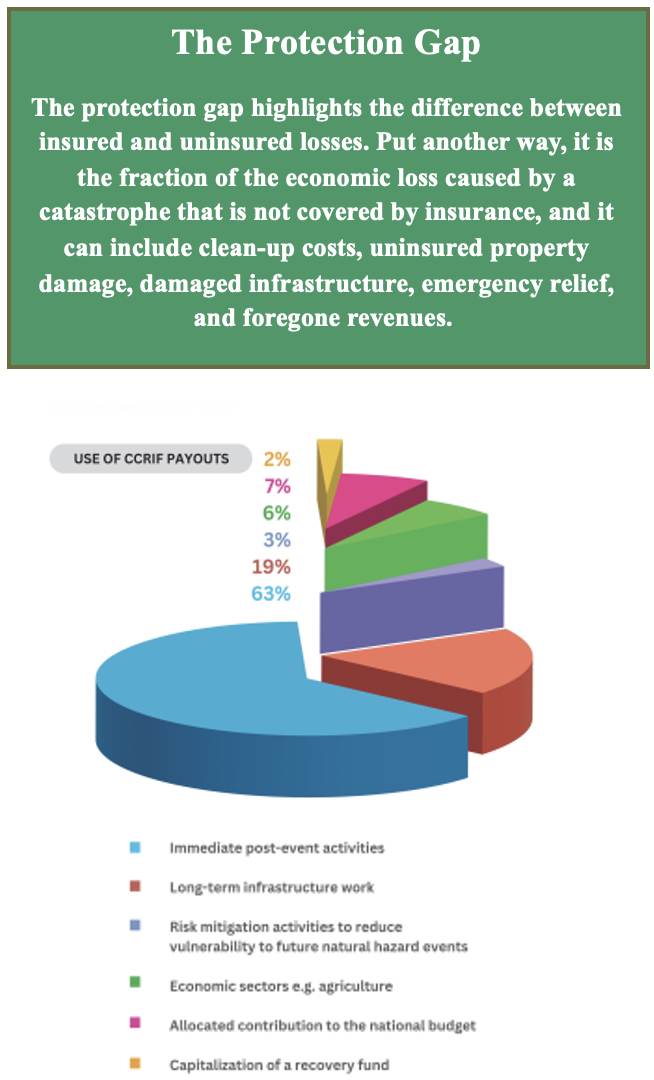

CCRIF payouts help to close the protection gap. Parametric insurance products are a key component in a country’s disaster risk financing (DRF) strategy and are designed to pre-finance short-term liquidity and help to close the protection gap, reduce budget volatility, and allow countries to respond to their most pressing needs post-disaster, including providing support to the most vulnerable. In the Caribbean and Latin America for example, insured losses represent a small fraction of the economic losses, strengthening the case in these highly exposed countries for CCRIF as a key vehicle to help close the protection gap. CCRIF has demonstrated that catastrophe risk insurance can effectively provide a level of financial protection for countries vulnerable to natural disasters.

country’s disaster risk financing (DRF) strategy and are designed to pre-finance short-term liquidity and help to close the protection gap, reduce budget volatility, and allow countries to respond to their most pressing needs post-disaster, including providing support to the most vulnerable. In the Caribbean and Latin America for example, insured losses represent a small fraction of the economic losses, strengthening the case in these highly exposed countries for CCRIF as a key vehicle to help close the protection gap. CCRIF has demonstrated that catastrophe risk insurance can effectively provide a level of financial protection for countries vulnerable to natural disasters.

Since its inception in 2007, CCRIF has made 78 payouts totalling US$390 million. Payout amounts increase with the level of modelled loss. CCRIF can provide coverage of up to US$150 million per peril insured. The figure at right shows how payouts have been used by members over the years.

Today CCRIF is recognized as the Caribbean and Central America’s development insurer, providing rapid payouts to members within 14 days of a catastrophic event when policies are triggered, even for multi-country events which cause millions of dollars in damage, such as Hurricane Beryl.

The table below provides a snapshot of how members used their payouts following Hurricane Beryl.

Use of CCRIF Payouts Following Hurricane Beryl

|

Member |

Payout (USD) |

Use of Payout(s) – Some Examples |

Beneficiaries |

|

1,862,728

|

|

3,300 (population of Union Island and Mayreau)

4,607 vulnerable persons under social protection

5,670 farmers and fishers |

|

|

Grenada

|

42,973,960

|

|

100% of population of Carriacou and Petite Martinique (4,111) + ~5,000 in Grenada = ~9,000 |

|

Grenada

|

1,066,667

On the Government’s COAST policy for fisheries |

|

600 fisherfolk |

|

GRENLEC - Grenada |

9,323,276 |

Repairs to: infrastructure in Grenada: broken poles, damaged transformers, and conductors; and power plants in Carriacou (damage to structure, doors, windows, roof) and Petite Martinique (wind and water damage, damage to roof) Allocation to resiliency projects: including Proposed Resilient Infrastructure Underground (UG) solutions: St George’s West feeder – installing underground infrastructure for the general hospital; Carriacou West feeder – installing underground infrastructure to desalination plant; BESS Limlair Solar Farm; Support grid update and resilience projects including BESS enhancements and integration |

Power was restored to 19,318 offline customers Grenada: 15,307 (25% of total customers) + Carriacou/Petite Martinique: 4,011 (100%)

|

|

NAWASA - Grenada |

2,201,833 |

|

The residents of Carriacou and Petite Martinique (population ~10,500 people) |

|

Trinidad & Tobago

|

372,752

On the Government’s TC policy for Tobago

|

|

550 direct beneficiaries Financial protection for 100% population of T&T: 1.53 million |

|

26,881,122

|

|

11,000 + economically vulnerable persons (MLSS) |

|

|

Cayman Turtle Conservation and Education Centre |

119,474 |

|

Users of the Centre – all residents of Cayman Islands (population: 75,443) |

|

TOTAL |

84,508,629 |

|

|