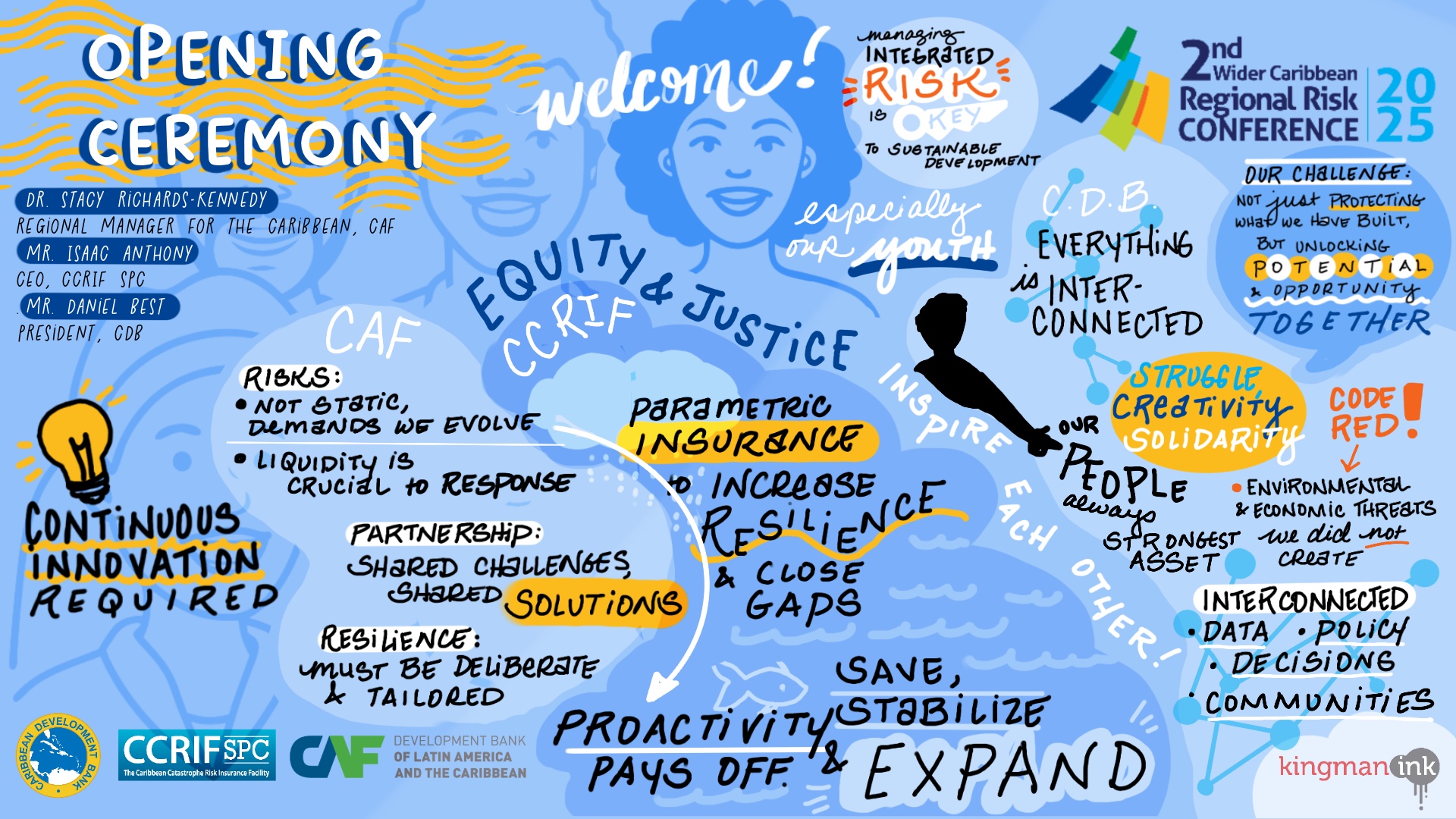

Opening Ceremony Summary Sketch

Panel 1 - Summary Sketch

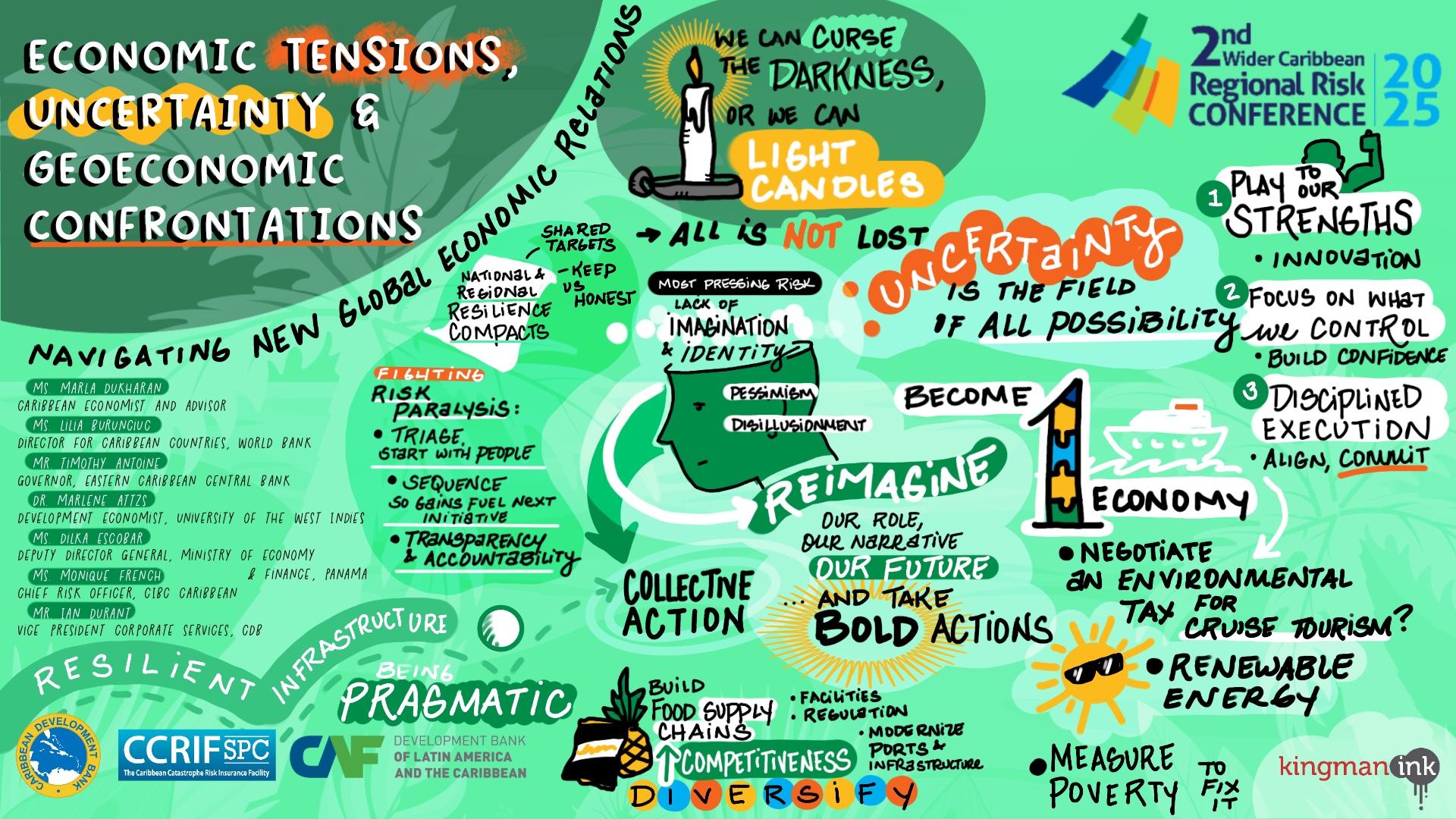

PANEL 1: Economic Tensions, Uncertainty, and Geoeconomic Confrontations: Navigating these new Global Economic Relations

The first panel, moderated by Ms. Marla Dukharan, emphasized the urgent need for the Caribbean to shift from risk paralysis and dependency towards bold, innovative, and collective solutions for sustainable development. Panelists highlighted longstanding issues such as sluggish economic growth, reliance on tourism and food imports, high energy costs, inequality, and fragmented governance. Despite these challenges, there was a shared optimism about the region’s resilience, creativity, and potential for transformation. Key solutions discussed included strengthening competitiveness, investing in resilient infrastructure, harmonizing policies, leveraging data and digital tools, and fostering transparency and accountability. The overarching message was that the Caribbean must act courageously and collaboratively to turn adversity into opportunities for a stronger future.

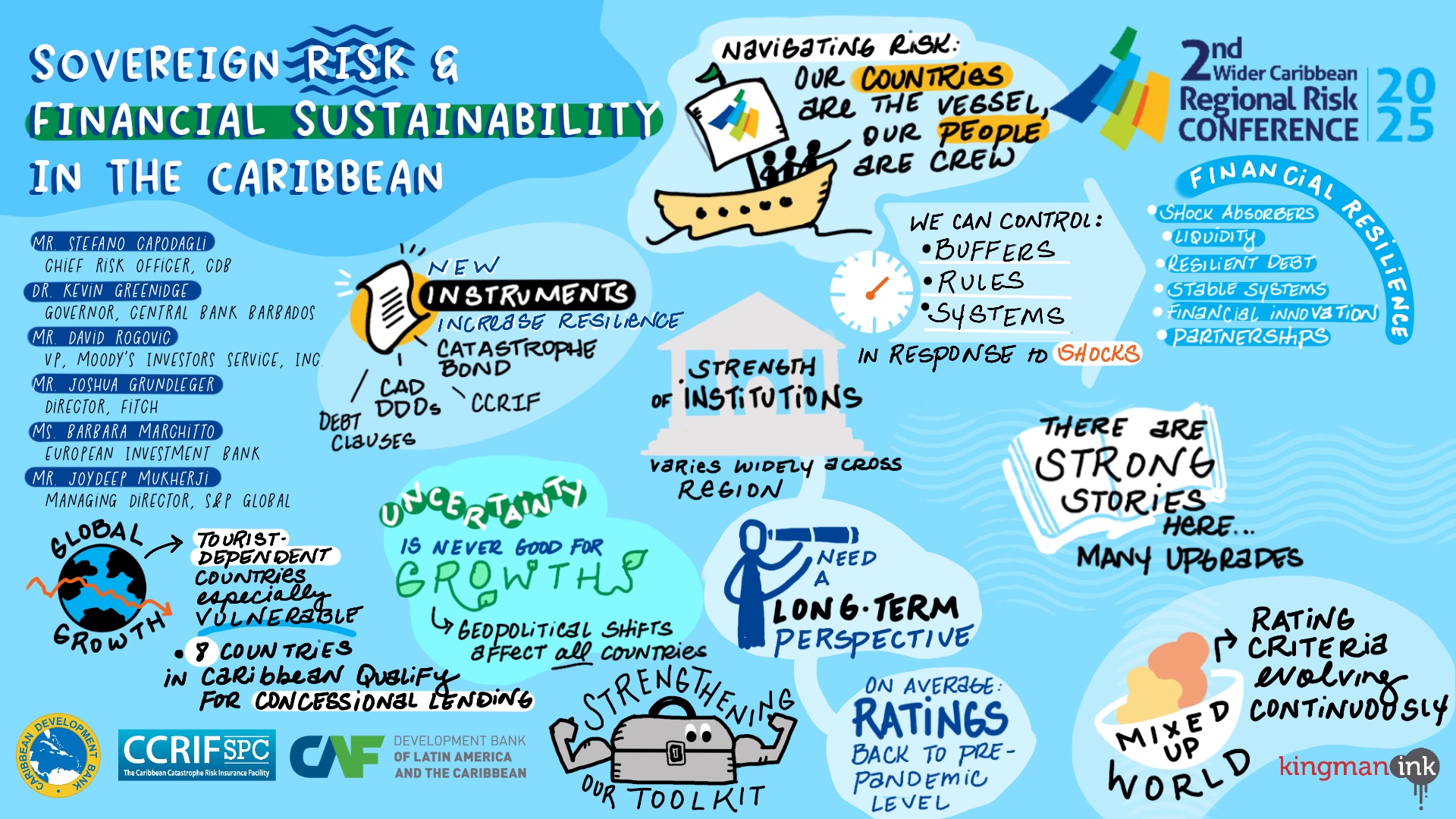

Panel 2 - Summary Sketch

PANEL 2: Sovereign Risk and Financial Sustainability in the Caribbean: Strategic Financing and MDB Interventions

Panel 2 focused on sovereign risk and financial sustainability in the Caribbean, emphasizing the importance of strategic financing and the role of multilateral development banks (MDBs) in strengthening regional resilience. Speakers highlighted recent progress, such as debt-for-climate swaps, fiscal responsibility frameworks, and credit upgrades, which demonstrate the region’s efforts to improve fiscal health despite high debt levels and climate vulnerabilities. The Central Bank of Barbados outlined six pillars of resilience—ranging from macroeconomic buffers to digital financial innovations—aimed at managing shocks and ensuring sustainable growth. Meanwhile, the World Bank and European Investment Bank discussed innovative financing tools, including catastrophe bonds and climate-sensitive debt mechanisms, as critical instruments to support Caribbean economies in navigating external shocks and climate hazards.

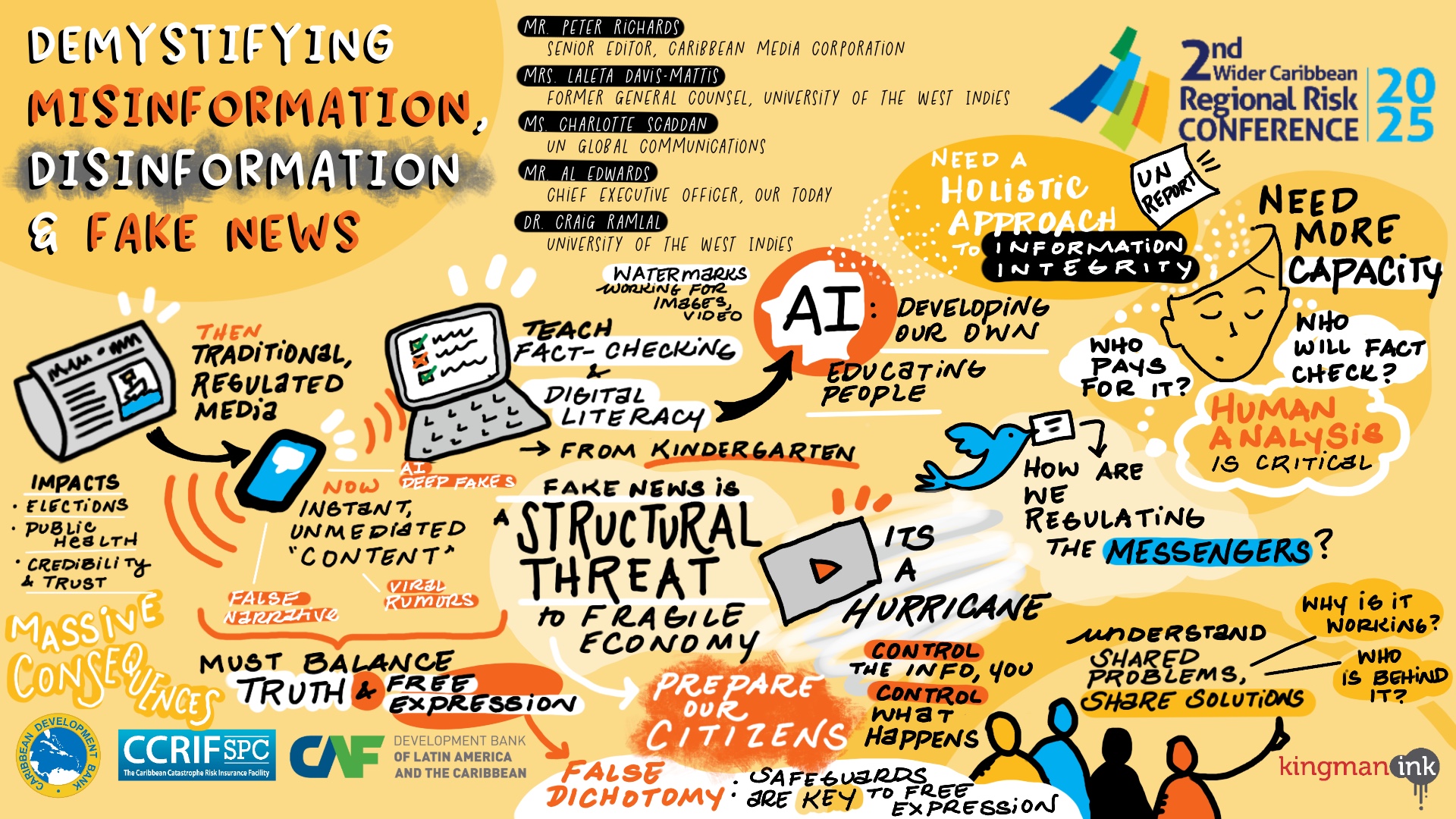

Panel 3 - Summary Sketch

PANEL 3: Demystifying Misinformation, Disinformation, and Fake News: How Risky are these to our Region’s Development?

Panel 3, moderated by Mr. Peter Richards, addressed the emerging risks posed by misinformation, disinformation, and AI-driven deepfakes to Caribbean governance, economies, and democracy. The panel emphasized that traditional checks and balances in media are eroding, with truth increasingly under siege due to fake news influencing elections, public trust, and social cohesion. Experts highlighted that AI systems are often trained on data with little Caribbean representation, making the region more vulnerable to misinformation embedded in external systems. They called for stronger media integrity, algorithmic transparency, human oversight, and region-specific regulations to safeguard information accuracy, while cautioning against measures that might infringe on freedom of speech.

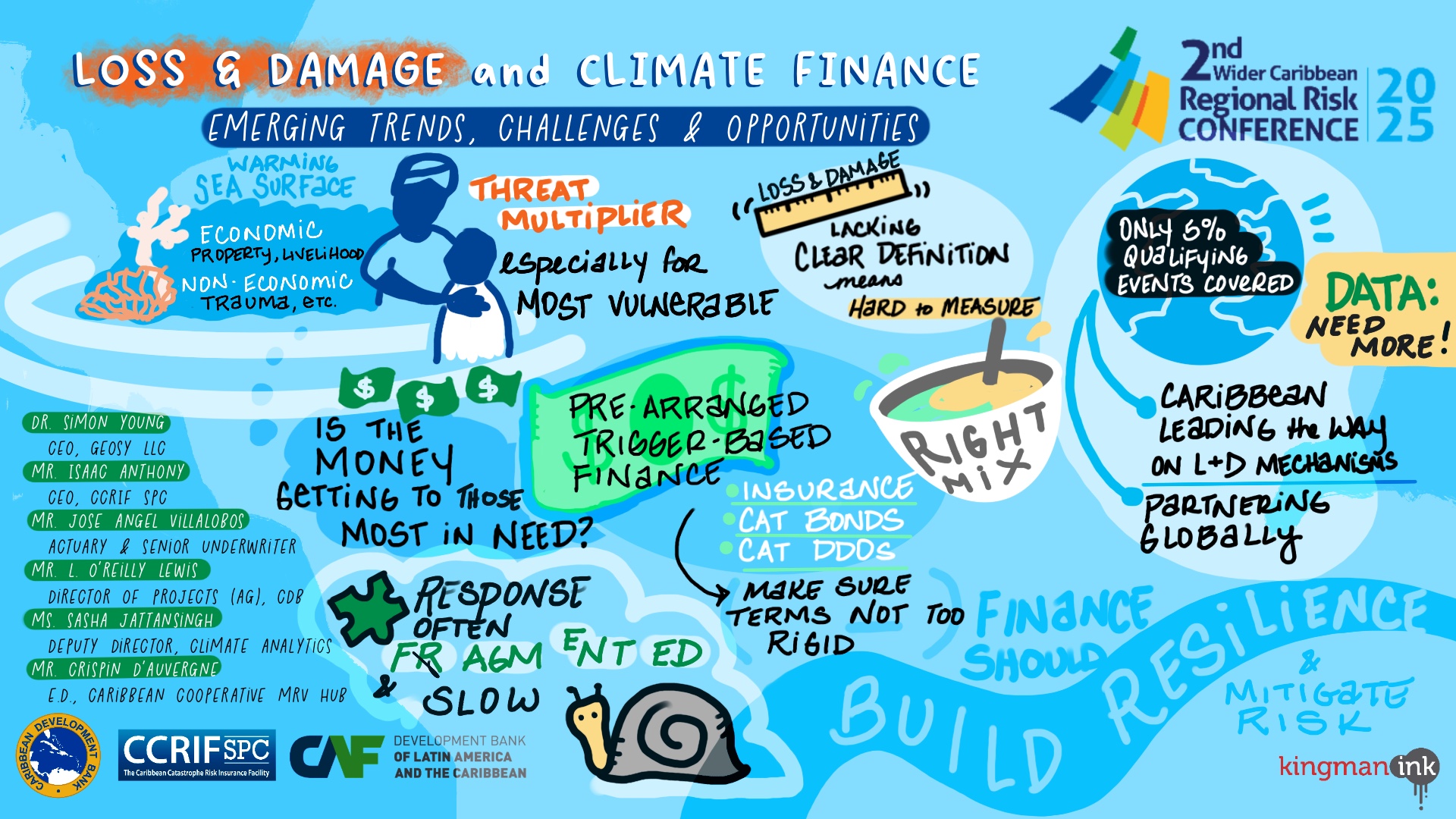

Panel 4 - Summary Sketch

PANEL 4: Loss and Damage and Climate Finance: Emerging Trends, Challenges and Opportunities

Panel 4 addressed the critical challenge of climate-related loss and damage (L&D) in the Caribbean, emphasizing the significant gaps in funding, data, and implementation capacity. The panelists underscored that current global mechanisms like the Fund for Responding to Loss and Damage (FRLD) remain underfunded and fragmented, hindering effective support for vulnerable communities. Innovative financial instruments such as parametric insurance, catastrophe bonds, debt-for-climate swaps, and concessional loans were highlighted as promising tools, although it was acknowledged that these alone cannot meet the scope of the region’s needs. The panel emphasized that stronger data frameworks, inclusive finance, and enhanced public-private partnerships are essential for ensuring resources reach grassroots communities and bolster regional resilience.

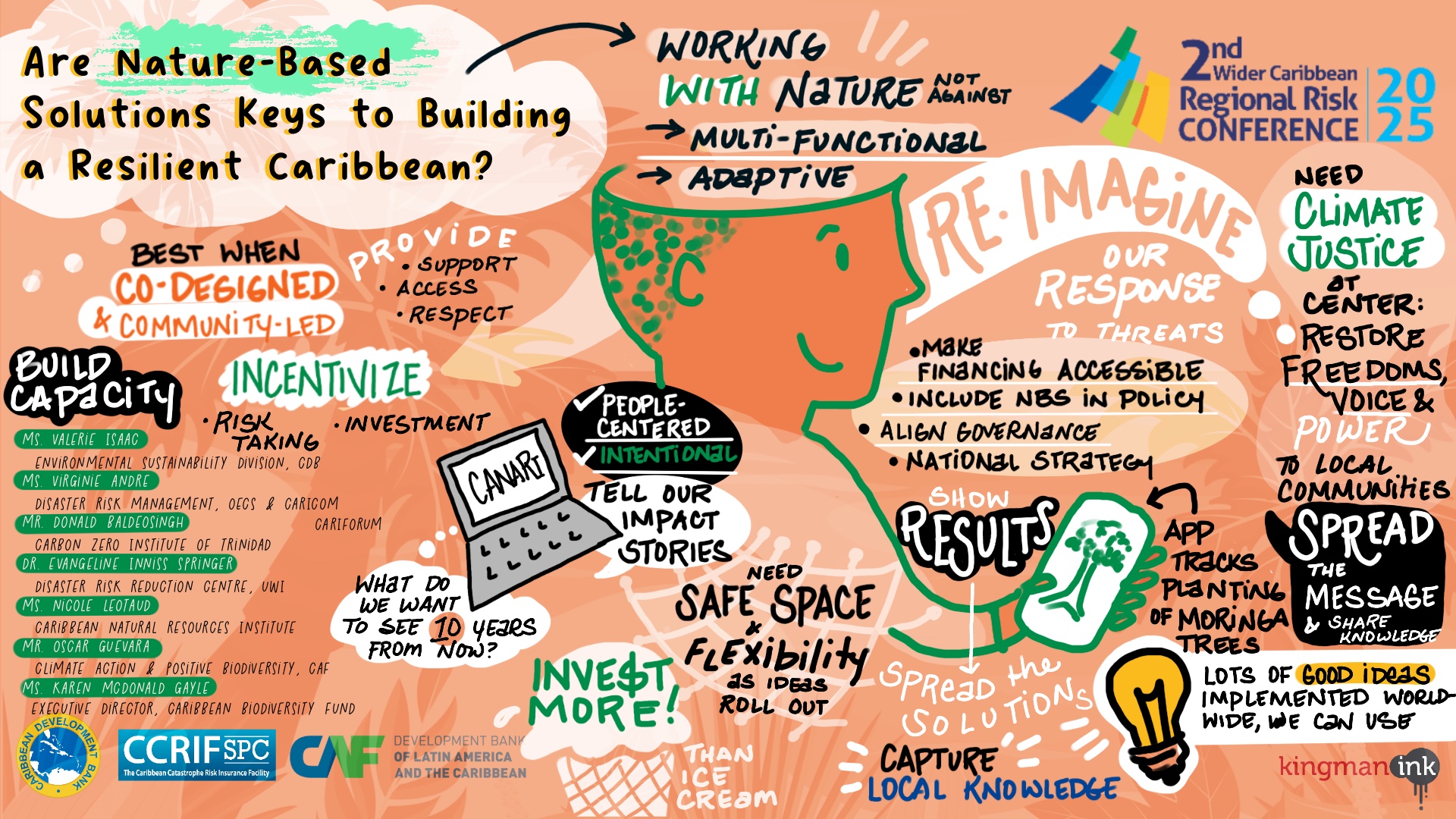

Panel 5 - Summary Sketch

PANEL 5: Are Nature-Based Solutions Keys to Building a Resilient Caribbean?

Panel 5 emphasized the significant potential of Nature-Based Solutions (NBS) in enhancing Caribbean resilience through multifunctional benefits such as environmental protection, supporting tourism, and fostering social and economic development. Speakers highlighted examples like mangrove restoration and coral survival projects, illustrating their capacity to strengthen communities and ecosystems. However, barriers such as fragmented governance, limited financing, and insufficient policy support were acknowledged. The panel called for mainstreaming NBS into national frameworks, securing long-term funding, and empowering local communities, with financing mechanisms from the EU, CAF, and the Caribbean Biodiversity Fund playing a crucial role. Emphasis was also placed on ensuring that NBS are implemented equitably, justice-driven, and community-centered to achieve sustainable, inclusive adaptation.

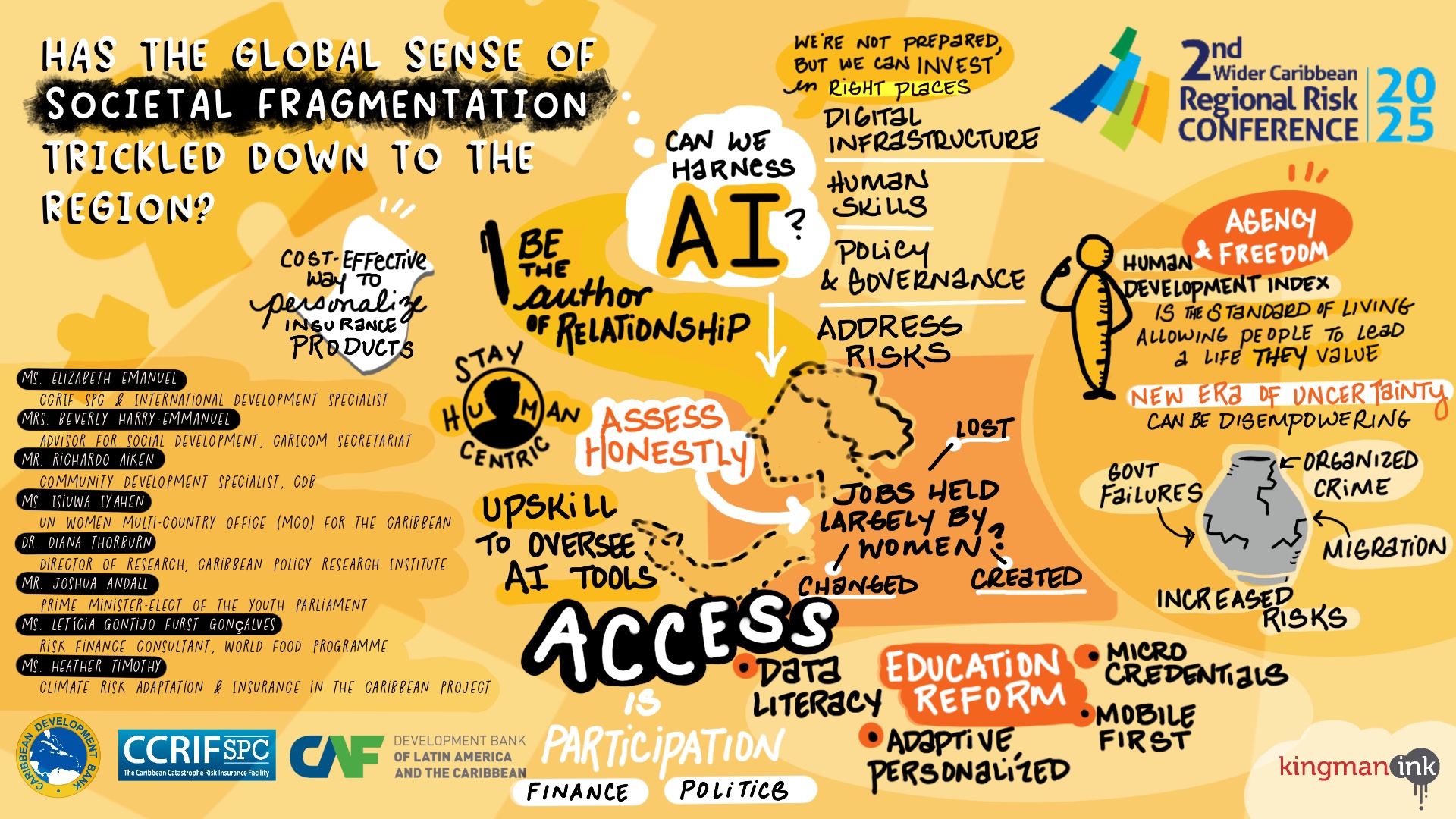

Panel 6 - Summary Sketch

PANEL 6: Has the Global Sense of Societal Fragmentation Trickled Down to the Region? The Region’s Response….

Panel 6 led by Elizabeth Emanuel, highlighted the urgent need for the Caribbean to prepare for the transformative potential and risks of AI, emphasizing that the region is currently unprepared due to gaps in digital infrastructure, skills, and governance. Experts agreed that AI can significantly support governance, social protection, and insurance, particularly if approached with a human-centered, ethical, and inclusive framework. Key strategies include investing in STEM education, lifelong learning, and community-driven digital literacy initiatives, with a focus on addressing inequality, gender, and youth engagement to ensure AI contributes to resilience, social equity, and sustainable development. The panel underscored that the region must prioritize education and inclusiveness to leverage AI's benefits while mitigating its risks.

Panel 7 - Summary Sketch

Panel 7: Unlocking Private Sector Potential and Risk-Sharing Solutions for Sustainable Development

Panel 7, led by Ms. Lisa Harding of the Caribbean Development Bank, focused on unlocking private sector potential and implementing risk-sharing solutions to drive sustainable development in the Caribbean. The panel highlighted that while the region’s banks are highly liquid, access to finance remains a challenge for SMEs due to risk aversion, governance issues, and regulatory constraints. Experts emphasized the importance of mobilizing capital through innovative models like blended finance, guarantees, and long-term institutional investments such as pension funds. They also underscored the need for stronger governance, tailored solutions, and enhanced connectivity to bridge the financing gap for small and medium enterprises, which are vital for regional resilience and socio-economic growth.

Closing Ceremony Summary Sketch