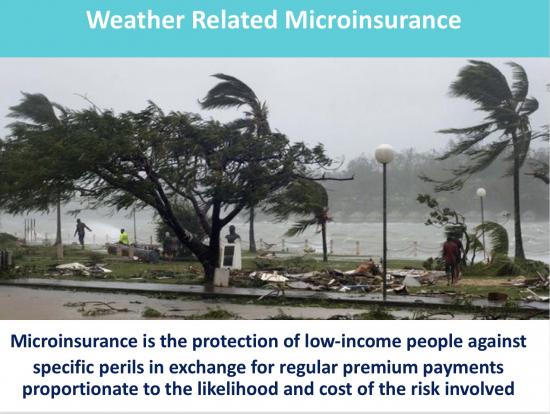

Microinsurance is the protection of low-income people against specific perils in exchange for regular premium payments proportionate to the likelihood and cost of the risk involved.

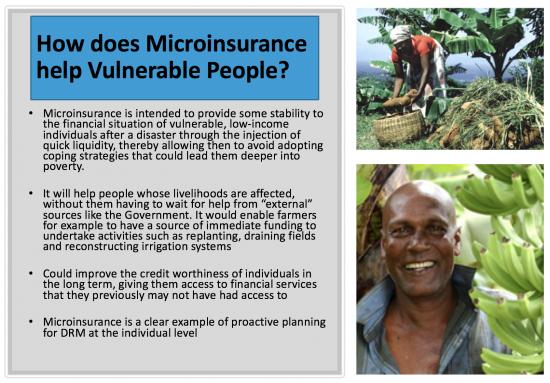

How does Microinsurance help Vulnerable People?

- Microinsurance is intended to provide some stability to the financial situation of vulnerable, low-income individuals after a disaster through the injection of

quick liquidity, thereby allowing then to avoid adopting coping strategies that could lead them deeper into poverty.

quick liquidity, thereby allowing then to avoid adopting coping strategies that could lead them deeper into poverty. - It will help people whose livelihoods are affected, without them having to wait for help from “external” sources like the Government. It would enable farmers for example to have a source of immediate funding to undertake activities such as replanting, draining fields and reconstructing irrigation systems.

- Could improve the credit worthiness of individuals in the long term, giving them access to financial services that they previously may not have had access to.

- Microinsurance is a clear example of proactive planning for DRM at the individual level.

English