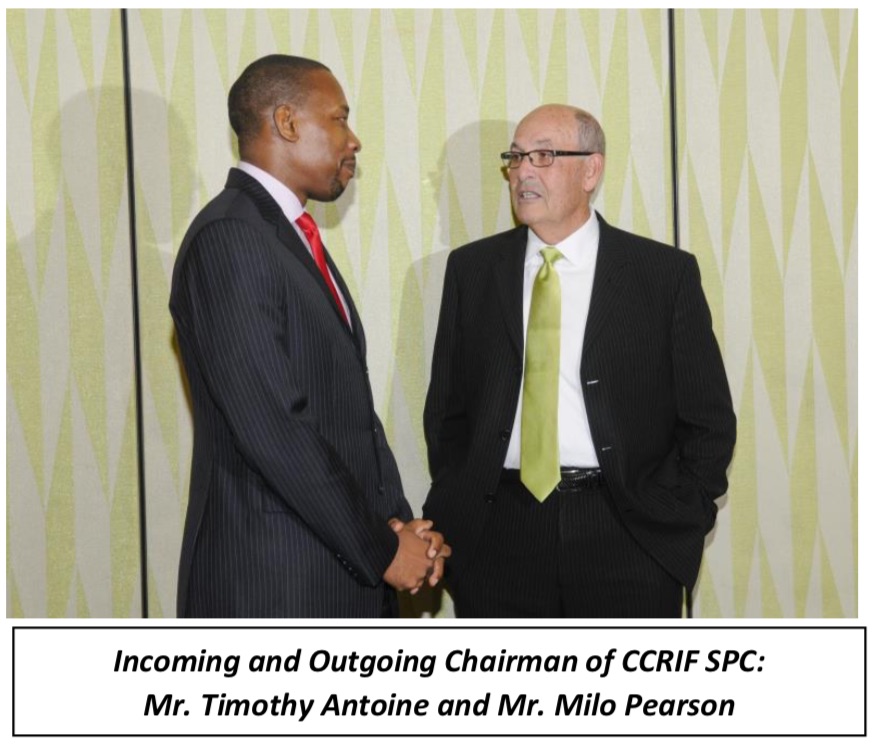

Grand Cayman, Cayman Islands, July 2, 2018. CCRIF SPC is pleased to announce the appointment of Mr. Timothy Antoine as Chairman of CCRIF SPC, effective July 1, for a 3-year term. Mr. Antoine succeeds Mr. Milo Pearson who chaired CCRIF’s board from its inception in 2007 and has now retired.

CCRIF SPC, effective July 1, for a 3-year term. Mr. Antoine succeeds Mr. Milo Pearson who chaired CCRIF’s board from its inception in 2007 and has now retired.

At a recent function hosted by CCRIF SPC to honour outgoing chairman Mr. Pearson, Mr. Antoine said, “I thank Milo Pearson, our longstanding chairman, for his sterling service to CCRIF and extend best wishes to him in his well-earned retirement. I look forward to working with my fellow Board members and our CEO, in this new capacity, as together we take CCRIF into its second decade and increase its impact on improving disaster risk management and building resilience in our region.”

During Mr. Pearson’s tenure as chairman, CCRIF has been internationally recognized and lauded as a global example and best practice for parametric insurance and country risk transfer. CCRIF has increased its product offerings from 2 to 3 adding an excess rainfall product to its original offerings of tropical cyclone and earthquake; expanded into Central America; and increased membership from the original 16 Caribbean members to 19 members with one member from Central America.

CCRIF continues to fulfil its mandate to provide quick liquidity to member governments after catastrophic events. Over the past 11

years, the Facility has made 36 payouts totalling US$130.5 million to 13 member governments, all within 14 days of the event. Importantly, CCRIF SPC continues to maintain its financial solvency and long-term sustainability even after payouts of US$62 million during the 2017 Atlantic Hurricane Season.

CCRIF SPC continues to maintain its financial solvency and long-term sustainability even after payouts of US$62 million during the 2017 Atlantic Hurricane Season.

Mr. Antoine is the Governor of the Eastern Caribbean Central Bank (ECCB). Prior to his current position, Mr. Antoine was the Permanent Secretary in Grenada’s Finance Ministry for 14 years. From 2005 to 2007, Mr. Antoine served as an Advisor to the Executive Director for Canada, Ireland and the Caribbean at the World Bank, working on behalf of the Caribbean, and played a significant role in the establishment of CCRIF in 2007. He has been a CARICOM appointed member of the CCRIF Board since 2014.

During the new chairman’s tenure, CCRIF will place a strong focus on scaling up the Facility. This focus has been given added impetus as governments and citizens in the region have witnessed first-hand the impacts of extreme geophysical and climate events – most notably Hurricanes Matthew, Irma and Maria in the past two years – and have been encouraged by CCRIF’s rapid response and payouts.

CCRIF’s new strategic plan for 2018-2021 will focus on scaling up, which will include, among other initiatives, the introduction of new products for drought, fisheries, agriculture, and other sectors where insurance coverage against natural hazards is not readily available. Of course, the Facility will continue to stay true to its core business of providing affordable parametric insurance products and quick payouts to members when their policies are triggered.

The Board of Directors works closely with CCRIF’s Chief Executive Officer, Mr. Isaac Anthony, who has successfully managed the operation of CCRIF and its team of service providers since 2013.

About CCRIF SPC: CCRIF SPC is a segregated portfolio company, owned, operated and registered in the Caribbean. It limits the financial impact of catastrophic hurricanes, earthquakes and excess rainfall events to Caribbean and – since 2015 – Central American governments by quickly providing short-term liquidity when a parametric insurance policy is triggered. It is the world’s first regional fund utilising parametric insurance, giving member governments the unique opportunity to purchase earthquake, hurricane and excess rainfall catastrophe coverage with lowest-possible pricing. CCRIF was developed under the technical leadership of the World Bank and with a grant from the Government of Japan. It was capitalized through contributions to a Multi-Donor Trust Fund (MDTF) by the Government of Canada, the European Union, the World Bank, the governments of the UK and France, the Caribbean Development Bank and the governments of Ireland and Bermuda, as well as through membership fees paid by participating governments. In 2014, an MDTF was established by the World Bank to support the development of CCRIF SPC’s new products for current and potential members, and facilitate the entry for Central American countries and additional Caribbean countries. The MDTF currently channels funds from various donors, including: Canada, through the Department of Foreign Affairs, Trade and Development; the United States, through the Department of the Treasury; the European Union, through the European Commission, and Germany, through the Federal Ministry for Economic Cooperation and Development. In 2017, the Caribbean Development Bank, with resources provided by Mexico, approved a grant to CCRIF SPC to provide enhanced insurance coverage to the Bank’s Borrowing Member Countries that insure through CCRIF against tropical cyclone, earthquake and excess rainfall risks.

English