Daily break:

11:30 am - 11:45 am (Eastern Caribbean Time)

10:30 am - 10:45 am (Jamaica Time)

9:30 am - 9:45 am (Belize Time)

|

Day 1 |

Introduction Introduction to CCRIF SPC Video: The Work and Impact of CCRIF SPC in the Caribbean and Central America The Linkages between Economic Policy and Disaster Risk Management The Caribbean’s natural hazard risk; the global context; impact of natural hazards; impacts of climate change How natural disasters impact the effectiveness of the economy to function Introduction to Economic Theory, Economic indicators Components of risk; risk assessments; insurance penetration in the region; disaster risk mitigation as part of disaster preparedness; linkages between disasters and fiscal and debt sustainability |

|

Day 2 |

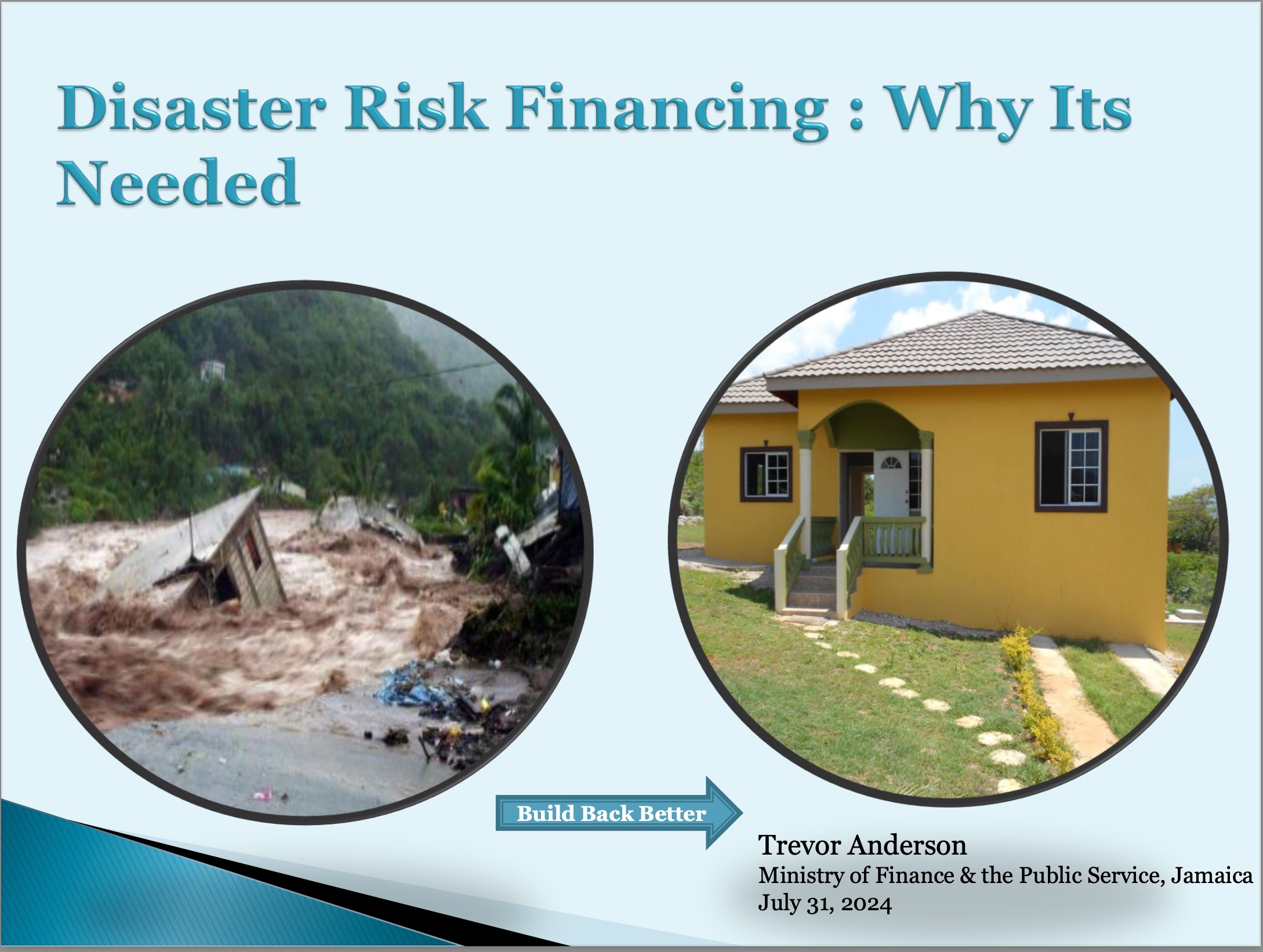

Comprehensive Disaster Risk Management Financing disaster risk reduction activitie

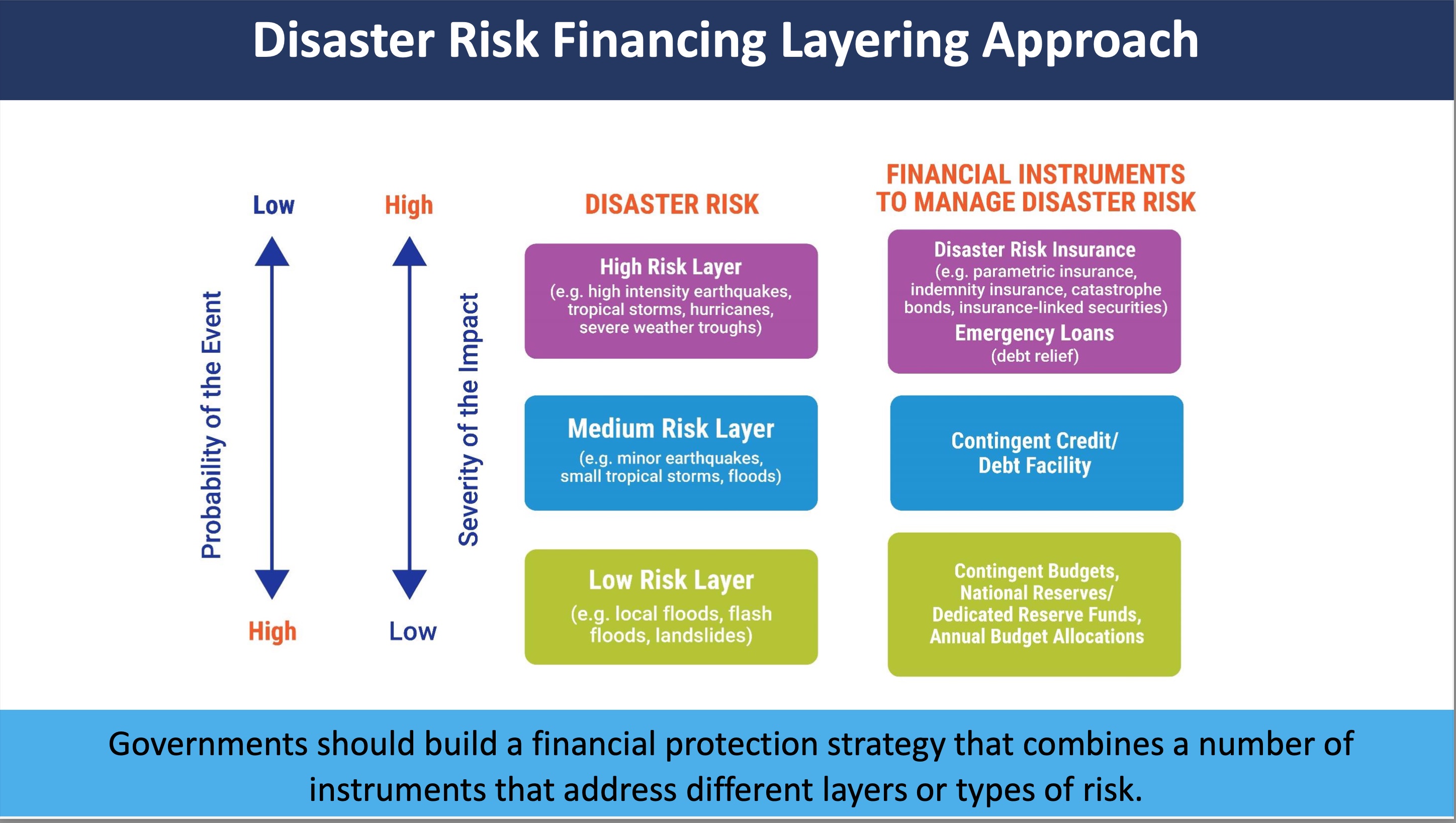

Risk financing instruments: risk transfer, parametric insurance (and difference between parametric insurance and indemnity insurance), cat bonds, cat DDOs, etc. Caribbean’s development insurance company: CCRIF SPC |

|

Day 3 |

Disaster Risk Financing – continued Closing the protection gap; financial protection and the State - developing a risk financing strategy Opening up financial inclusion e.g. through microinsurance |

|

Day 4 |

Understanding CCRIF’s Parametric Insurance Policies, Models, Tools and Country Risk Profiles CCRIF products (current and new products in development) How CCRIF policies work – the CCRIF parametric model construct Introduction to CCRIF models Elements of CCRIF policies; how policies are triggered and payouts calculated Introduction to country risk profiles and their uses in national development Introduction to WeMAp: TC, EQ and XSR Monitoring Tool and Real-Time Forecasting System (RTFS) |

|

Day 5 |

Shock Responsive Social Protection and DRM and Insurance The linkages between DRM and social protection Understanding shock responsive social protection and climate smart and adaptive social protection Introducing microinsurance as a key component of shock responsive social protection Use of insurance in protecting the poor and most vulnerable Microinsurance in the Caribbean context: introducing the Climate Risk Adaptation and Insurance in the Caribbean Project and the Livelihood Protection Policy Introduction to Integrated Risk Management Different types of risk All-hazards risk management |