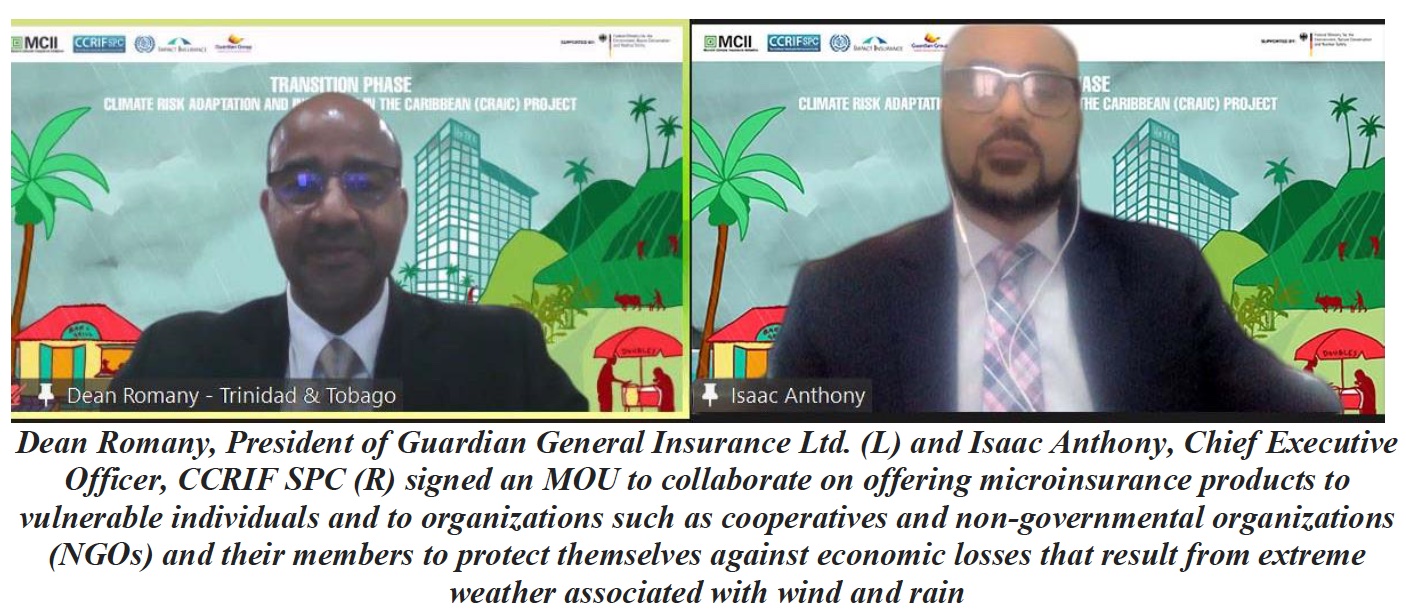

Grand Cayman, Cayman Islands, February 2, 2022. Today, CCRIF and Guardian General Insurance Limited signed a Memorandum of Understanding to offer individuals and organizations such as cooperatives and non-governmental organizations (NGOs) and their members the ability to protect themselves against economic losses that result from extreme weather associated with wind and rain. Guardian General Insurance Limited will provide access to the Livelihood Protection Policy (LPP) – a parametric microinsurance product designed to help protect the livelihoods of low-income and vulnerable persons such as small farmers, seasonal tourism workers, fishers, market and food vendors, musicians, day labourers, and small entrepreneurs, by providing quick cash payouts following extreme weather events (specifically, high winds and heavy rainfall).

The LPP was developed under the Climate Risk Adaptation and Insurance in the Caribbean (CRAIC) Project, which has been promoting microinsurance for climate risk in the Caribbean since 2011. CRAIC is implemented by the Munich Climate Insurance Initiative (MCII), CCRIF SPC, and ILO Impact Insurance, with support from the International Climate Initiative of the German Federal Ministry for the Environment, Nature Conservation, and Nuclear Safety. It is being implemented in 5 pilot countries - Belize, Grenada, Jamaica, Saint Lucia and Trinidad and Tobago.

CCRIF’s CEO, Isaac Anthony welcomed Guardian General Insurance as a partner, stating: “We see this partnership between CCRIF and Guardian General Insurance Limited as a win-win. We are encouraged that Guardian General has included the CRAIC project as part of its overall business strategy. What is key for us at CCRIF, is that Guardian General operates in all of the 5 pilot countries, and we see this as a first step towards scaling up and making this innovative product available to the various target groups. With Guardian General and its networks across the pilot countries, we will have multiple distribution channels for persons to access the LPP”.

By aligning microinsurance to its overall business strategy, Guardian General has signalled its intent to invest time and resources in regulatory approvals and product roll-out, and ultimately to have a major stake in the success of the Transition Phase of the CRAIC.

Guardian General’s President, Dean Romany, stated, “Parametric products can be instrumental in alleviating the immediate negative financial impact on an underserved portion of our population, such as SME owners or self-employed individuals in the aquaculture, agribusiness, food & beverage, construction, hospitality, and transportation sectors.”

CRAIC is the first project of its kind in the Caribbean region and was designed as a learning project, allowing the project consortium to capture lessons learned during the first two implementation phases. From the early days of implementation, the project has demonstrated value to its policyholders. For example, in 2013, following the introduction of the LPP in Saint Lucia, policyholders – mainly small farmers – received the first payouts on their policies after the “December rains” that affected the island. As with CCRIF’s sovereign parametric policies, payouts were made within 14 days. In the years since, policyholders have received payouts after a number of events such as Hurricane Matthew, when 31 fishers and farmers in Saint Lucia received US$102,000 for that event.

The MOU signing today took place at the launch of the Transition Phase of the project, which was attended by over 50 persons. The Transition Phase, to be led by CCRIF, will use the lessons learned from the first 10 years of the project to promote wider access to the LPP within the 5 pilot countries. The intent is to fully roll out the LPP in all CCRIF member countries following the Transition Phase. Soenke Kreft, Executive Director of MCII was enthusiastic about the next phase: “This moment represents a new era in the relationship between the Munich Climate Insurance Initiative and CCRIF SPC. We at MCII are thrilled that CCRIF SPC is stepping into this new role, scaling up access to microinsurance products through leadership and partnerships with Caribbean insurers, governments and stakeholders.”

During the Transition Phase, all partners also will work with policymakers, regulators, and relevant ministries and agencies of government to create an enabling environment for the growth of climate risk insurance and to embed it within social protection and national disaster risk reduction strategies. These activities are intended to further build social and economic resilience of vulnerable populations, and increase national adaptive capacity towards eliminating poverty in keeping with the thrust of ‘leaving no one behind’ and advancing the achievement of the Sustainable Development Goals.

About CCRIF SPC:

CCRIF SPC (formerly the Caribbean Catastrophe Risk Insurance Facility) is the world's first multi-country, multi-peril risk pool based on parametric insurance. CCRIF provides parametric catastrophe insurance for Caribbean and Central American governments, and for electric utility companies. CCRIF offers parametric insurance for tropical cyclones, excess rainfall, and earthquakes and for the fisheries and electric utilities sectors – insurance products not readily available in traditional insurance markets. The Facility operates as a developmental insurance company – as the goods and services it provides are designed to enhance the overall developmental prospects of its members. CCRIF has 23 members – 19 Caribbean governments, 3 Central American governments and 1 Caribbean electric utility company. Since its inception in 2007, CCRIF has made 54 payouts totalling US$245 million to 16 of its members. All payouts are paid within 14 days of the event.

CCRIF was developed under the technical leadership of the World Bank and with a grant from the Government of Japan. It was capitalized through contributions to a Multi-Donor Trust Fund (MDTF) by the Government of Canada, the European Union, the World Bank, the governments of the UK and France, the Caribbean Development Bank and the governments of Ireland and Bermuda, as well as through membership fees paid by participating governments. In 2014, a second MDTF was established by the World Bank to support the development of CCRIF SPC’s new products for current and potential members and facilitate the entry of Central American countries and additional Caribbean countries. The MDTF currently channels funds from various donors, including: Canada, through Global Affairs Canada; the United States, through the Department of the Treasury; the European Union, through the European Commission, and Germany, through the Federal Ministry for Economic Cooperation and Development and KfW. Additional financing has been provided by the Caribbean Development Bank, with resources provided by Mexico; the Government of Ireland; and the European Union through its Regional Resilience Building Facility managed by the Global Facility for Disaster Reduction and Recovery (GFDRR) and The World Bank.

About Guardian General Insurance Limited:

Guardian General Insurance Limited (GGIL) is the amalgamation of Caribbean Home Insurance Company Limited and NEM (West Indies) Insurance Limited (NEMWIL), with over one hundred (100) years in the general insurance business in Trinidad and Tobago, Barbados and several territories in the Eastern and Northern Caribbean. As part of the largest indigenous financial services and insurance group in the English- and Dutch-speaking Caribbean under the umbrella brand, Guardian Group, Guardian General Insurance Limited also has operations in Jamaica (Guardian General Insurance Jamaica Limited) and offers a comprehensive portfolio of Property and Casualty Insurance products including Motor, Property, Bonding & Crime, Liability, Marine and Travel.

For yet another year, Guardian General Insurance Limited has been affirmed with the financial strength rating (FSR) of A- (Excellent) for 2018. Guardian General Insurance Limited has also been awarded 2013 World Finance Award.

For more information visit the Guardian website at: myguardiangroup.com