Grand Cayman, Cayman Islands, February 27, 2023. Over 50 technocrats from 18 CCRIF Caribbean member countries and two regional organizations, met face-to-face in Miami over two days – February 16 and 17, 2023 – to deepen their knowledge and understanding of CCRIF’s parametric insurance models and products. CCRIF also took the opportunity to share with members the upgrades to its tropical cyclone, excess rainfall and earthquake models that are expected to underpin the Facility’s policies for the 2023/24 policy year which begins on June 1, 2023. The workshop also allowed for virtual participation and about an additional 16 persons from member countries and regional organizations participated online over the two days.

Participants at the technical workshop included officials from the ministries of finance, meteorological officers and disaster risk managers. The various sessions of the workshop allowed participants to delve deeper into the:

Participants at the technical workshop included officials from the ministries of finance, meteorological officers and disaster risk managers. The various sessions of the workshop allowed participants to delve deeper into the:

- Hazard, exposure and vulnerability modules of the tropical cyclone, excess rainfall and earthquake models and the construct of these modules including the data used

- Upgrades to the CCRIF models and the rationale for the upgrades

- Elements of CCRIF policies (attachment point, exhaustion point, ceding percentage) and how and when policies are triggered

- Use of CCRIF WeMAp – CCRIF’s web-based platform through which members can monitor earthquakes as well as the development of potentially damaging heavy rainfall and tropical cyclones, analyze their intensity and assess their impact, as well as check whether an active insurance policy with CCRIF is likely to be triggered

- Need for incorporating several disaster risk financing (DRF) instruments as part of a government’s financial protection strategy. Mr. Trevor Anderson of Jamaica's Ministry of Finance and the Public Service shared Jamaica’s experience with DRF tools and its approaches to risk layering.

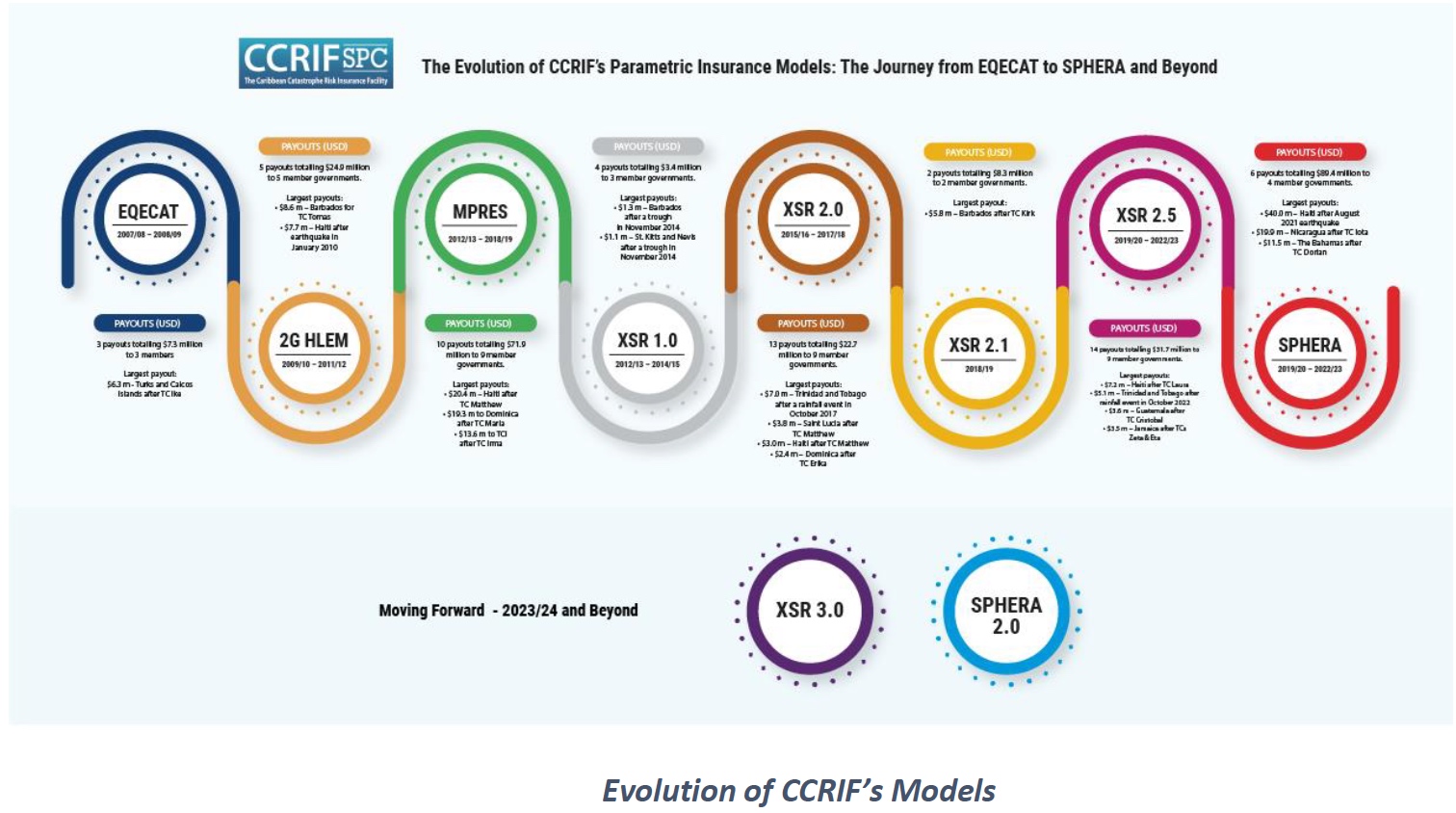

One particularly interesting session was the evolution of CCRIF’s parametric insurance models: The Journey from EQECAT to SPHERA and Beyond. CCRIF’s ability to provide parametric insurance coverage has always been underpinned by its parametric insurance models – which have evolved over the years... moving from off-the-shelf models to CCRIF-customized models and finally to models that are fully owned by CCRIF and designed specifically for the Caribbean and Central American countries. According to CCRIF CEO, Mr. Isaac Anthony, “From its inception, CCRIF has based its operations on continuous improvement, and this has emerged as one of the core principles underpinning the corporate governance framework of the Facility.” As new data and changes and improvements in model development emerge, CCRIF engages in model upgrades to ensure that its members can purchase parametric insurance policies underpinned by the best models of the time, that reduce the incidence of basis risk - a characteristic inherent in parametric insurance. Mr. Anthony further stated that “CCRIF is a sound financial institution and a development insurance company, serving the Caribbean and Central America, providing rapid payouts to governments within 14 days of a catastrophic event when policies are triggered, even for multi-country impact events as was the case of Hurricanes Maria and Irma in 2017 and more recently Hurricanes Iota and Eta, which impacted several countries in both regions simultaneously.”

The workshop was led by CCRIF CEO, Mr. Isaac Anthony and facilitated by members of the CCRIF management team and CCRIF’s service provider teams ERN-RED and Sustainability Managers. The workshop was made possible with financial support from the European Union in the framework of the Caribbean Regional Resilience Building Facility, managed by the Global Facility for Disaster Reduction and Recovery (GFDRR).

Today CCRIF provides parametric insurance coverage for tropical cyclones, earthquakes and excess rainfall and the fisheries sector to Caribbean and Central American governments and for tropical cyclones to Caribbean electric utility companies.

Since its inception in 2007, CCRIF has made 58 payouts, totalling US$260 million to 16 of its 24 members. During the 2022 Hurricane Season, CCRIF made 4 payouts totalling US$15.2 million to 3 of its member governments all within 14 days of the event. CCRIF has been designed to fill the liquidity gap to support immediate needs of the government and affected populations and infrastructure, and therefore occupies that critical space in post-disaster needs of governments, between immediate relief (0 – 5 days after an event) and long-term reconstruction and recovery.

About CCRIF SPC:

CCRIF SPC is a segregated portfolio company, owned, operated and registered in the Caribbean. It limits the financial impact of catastrophic hurricanes, earthquakes and excess rainfall events to Caribbean and Central American governments by quickly providing short-term liquidity when a parametric insurance policy is triggered. It is the world’s first regional fund utilising parametric insurance, giving member governments the unique opportunity to purchase earthquake, hurricane and excess rainfall catastrophe coverage with lowest-possible pricing. CCRIF was developed under the technical leadership of the World Bank and with a grant from the Government of Japan. It was capitalized through contributions to a Multi-Donor Trust Fund (MDTF) by the Government of Canada, the European Union, the World Bank, the governments of the UK and France, the Caribbean Development Bank and the governments of Ireland and Bermuda, as well as through membership fees paid by participating governments. In 2014, a second MDTF was established by the World Bank to support the development of CCRIF SPC’s new products for current and potential members and facilitate the entry of Central American countries and additional Caribbean countries. The MDTF currently channels funds from various donors, including: Canada, through Global Affairs Canada; the United States, through the Department of the Treasury; the European Union, through the European Commission, and Germany, through the Federal Ministry for Economic Cooperation and Development and KfW. Additional financing has been provided by the Caribbean Development Bank, with resources provided by Mexico; the Government of Ireland; and the European Union through its Regional Resilience Building Facility managed by the Global Facility for Disaster Reduction and Recovery (GFDRR) and The World Bank.